This post may contain affiliate links. FinanceSuperhero only recommends products we know and trust ourselves.

This post, “Stop Money Fights With This Simple Solution,” was updated on February 16, 2017.

Like many people, I lived in the dorms back in my college days. After surviving one semester with The World’s Worst Roommate™, I was fortunate to be granted a housing change. My new roommate, Erik, was everything one could hope for in a roommate: he picked up after himself, showered daily, loved to play table tennis until all hours of the night, and could binge watch TV like a pro.

Among the many shows Erik and I binged on, Married With Children was our favorite. Can you blame us? Ed O’Neill played the role of Al Bundy, a henpecked husband, broke shoe salesman, and father of two, to perfection.

Brief digression: It is a crime that O’Neill never won a Golden Globe for his performance as Al Bundy, though his career has been unquestionably validated by countless nominations and awards for his performance as Jay Pritchett in Modern Family.

Brief digression: It is a crime that O’Neill never won a Golden Globe for his performance as Al Bundy, though his career has been unquestionably validated by countless nominations and awards for his performance as Jay Pritchett in Modern Family.

In one memorable scene, Al’s wife, Peggy, has just returned home from a lavish shopping spree. Al takes a look at the bills and delivers a typical, priceless line:

I hope one of these bills is for a coffin, because your shopping is killing me.

While MWC was a slapstick, controversial comedy which often crossed the line, this particular money fight between Al and Peggy hit the nail on the head in terms of its value as a social commentary.

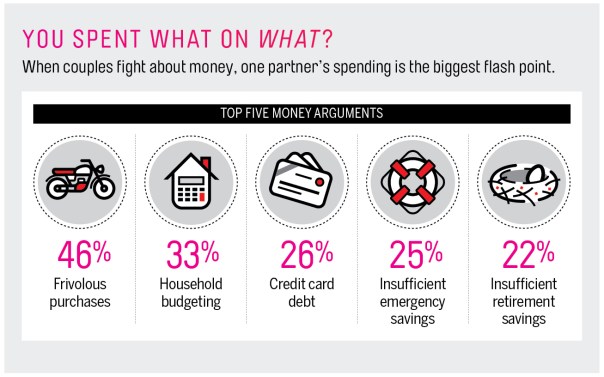

Research supports my assertion. According to a Huffington Post article from 2014, a survey showed “that 70 percent of couples argued about money more than household chores, togetherness, sex, snoring and what’s for dinner.” Furthermore, survey records that the focus of 46% of all money fights was “frivolous purchases.”

I suspect that 54% of surveyed couples were not being entirely honest.

Mission: Stop Money Fights in Marriage

Last fall, I volunteered as a co-facilitator for a popular personal finance course. I have always enjoyed engaging in financial discussions with others, despite the general unwillingness to do so in most people, and serving as a group leader satisfied that urge while also providing a platform to help people and sharpen my own knowledge.

During our session on purchasing, a student in my group shared that she and her husband had previously been through several fights about spending over the years. I braced myself for a plea for advice, but what she said next surprised me.

“We found a solution that has stopped most of our money fights.”

Chatter among the group instantly ceased. Each group member, including me, was eager to learn this couple’s secret to stop money fights?

Solution: The Thirty Day List

In the moments which followed, we learned a lot about this couple’s experiences. Throughout their marriage and subsequent ushering of two children into the world, this couple had fought about many purchases: vehicles, clothing, electronics, and even groceries. Matters were not made any easier when the couple encountered financial hardships. In order to reduce and stop money fights specifically related to purchases, this couple implemented a procedure that they called “The Thirty Day List.”

They outlined the rules as follows:

When considering a purchase over $50, write the item and cost down on the list and date the entry.

Provide a brief rationale regarding the item’s utility and importance.

Revisit the rationale in 30 days. If it still sounds like a good idea at that time, purchase the item.

Naturally, many students (budget nerds) were in favor of this approach, while other students (free spirit spenders) were against the restriction associated with this process. However, as the couple explained how it worked for them, the tone of the room shifted toward acceptance of this uncommon procedure. Some people even expressed hope that use of The List could stop money fights in their marriage.

Why The List Works

Among the benefits of the list which were described that day include the following:

- The List often prevents unnecessary purchases. Sometimes you don’t buy the item because you realize don’t really need it.

- The List eliminates susceptibility to high-pressure sales techniques. When a smooth talking salesman is rolling out every tactic in his arsenal to get you to purchase that new refrigerator with built-in social media access, you don’t even have to feel bad saying “no” because you are acting on a matter of principle.

- The List causes you to wait, and sometimes this nets you a better deal. Patience puts you in a position to negotiate a great price. This extra time also allows you to thoroughly research a product, weigh the pros and cons of the purchase, and make a careful evaluation.

- Similarly, after waiting 30 days, you retain the willpower to reject a bad deal. What is a few more days? You are in control and have the power to walk away.

Why The List Works

The Thirty Day List works in many situations because it leads to communication. When a couple collaborates to generate a unified position, a meeting of the minds and melding of ideas is often the result. However, this does not always happen quickly.

In such cases, a couple must take a step back and view the possible purchase from a wider perspective. By considering the purpose of the purchase from a variety of perspectives, the tone of communication shifts from one which is adversarial to one which is inclusive of both partners’ values.

Related Posts: See Values and Budgeting Part One and Values and Budgeting Part Two

Finally, the List provides accountability for larger purchases. It provides a framework and protocol which eliminates one partner from “going rogue.”

Downsides to The List

While the Thirty Day List may seem faultless in theory, it can be more difficult to implement in actual practice. After all, we live in a society in which it is easier and (often preferred) to ask for forgiveness after the fact rather than seek permission in advance. Many people would agree that this is a terrible way to act within your marriage or other committed relationship, yet that doesn’t stop some people. If this is your preferred practice, the List won’t work well for you.

The List is also not a good idea when you find yourself in a housing search, especially in a seller’s market. Often times, you will need to be poised to make quick decisions. This shouldn’t be a surprise, however, as when you are in the midst of such a search, you know the rationale and utility for the purchase.

Make the List Work For You

Perhaps the greatest feature of the List is that it can be modified to fit your circumstances. A high school student with a part-time job and an annual income of $1,200 and a married couple with a combined annual income of $500,000 can successfully use the List to their respective advantages. The figures may need to be modified, but at the end of the day, the principles remain the same whether zeros are added or removed.

If thirty days is too cumbersome for you, modify the procedure to fit your needs. You know yourself better than anyone, and using this knowledge is the best course of action when designing a List which will work for you to stop money fights and support wise purchases.

Further Recommended Reading:

Money and Marriage: How to Talk About Money With Your Spouse

Want To Be Rich? Maintain Great Relationships

Readers, do you have a procedure similar to The List in place to assist when making significant purchases? Do you and your spouse or significant other routinely fight about purchases? What do you do to stop money fights?

The Green Swan says

The Green Swan says

May 11, 2016 at 4:23 AMI have never heard of the 30 day list before but I like it! Thanks for sharing.

Apathy Ends says

Apathy Ends says

May 11, 2016 at 9:35 PMDefinitely and interesting approach, before we figured out our financial life a few years ago, we would fight over frivolous purchases.

I could see doing this for more substantial purchases – at a minimum we could use it as an excuse to get out of high pressure sales situations

Hero says

Hero says

May 11, 2016 at 9:37 PMI think that (avoiding high pressure sales) is the biggest value that the list can provide for me and Mrs. Superhero, as well, Apathy Ends. In order for the list to be more applicable to our current circumstances, the figure would need to be higher than $50.

Stefan @Mllnnlbudget says

Stefan @Mllnnlbudget says

May 12, 2016 at 8:19 AMNever heard of this approach and it is pretty interesting. I would use this approach more for major purchases with potentially a higher dollar cap but like you said everybody needs to adjust their own limit. 30 days is an awfully long time but the beauty with it is that 99% of the items you want to purchase I am sure you don’t, talk about great savings

amber tree says

amber tree says

May 12, 2016 at 3:25 PMThis would have been a good principle to apply when I was addicted to crowdfunding products… I set a limit of 5 open deals together and ended up with 10. The excuse: They are delayed, so it does not count…

As we now have fun money we can use, I see less need to do so. It makes sense for bigger purchases like a new table, out door lightning,… It can help to define a need from a want.

Michael @ Financially Alert says

Michael @ Financially Alert says

May 13, 2016 at 3:14 AMCool idea here. Communication is definitely the key with any relationship and finances are an important topic to address early on.

Luckily for me, my wife and I see eye to eye on the finances. But, we definitely sat down before we got married just to be on the same page. Thankfully it’s been smooth sailing from here, but I know A LOT of others who aren’t as lucky.

They should try the list!

Hero says

Hero says

May 13, 2016 at 8:45 AMMichael, you and your wife were wise to lay a solid financial foundation prior to getting married. The List certainly isn’t for rockstars like you guys, but it could come in handy someday when contemplating a large, out-of-the-ordinary purchase.

Michelle says

Michelle says

May 13, 2016 at 11:42 AMI like to think about a big purchase for at least a few days before I make it. I really hate clutter and wasting money!

Financial Slacker says

Financial Slacker says

May 13, 2016 at 3:53 PMIt’s funny how two people can see a spending situation so differently.

Years ago, Ms. Financial Slacker and I somehow got talked into sitting through a timeshare presentation. When we left, I immediately started talking about “who would ever buy one of these things.” While she had the exact opposite reaction and wanted to buy it right then.

Our spending personalities couldn’t be more opposite. I get almost physically sick when I spend money, while Ms. FS doesn’t like to spend time shopping at all, she just wants to buy.

It’s so important that couples figure out each others’ spending personalities and devise methods to control the spending and still get along.

ZJ Thorne says

ZJ Thorne says

May 27, 2016 at 3:05 PMThis is a great approach. I love including the rationale in writing. It’s so easy to change what you “always meant,” but your handwriting does not lie the way your brain mis-remembers.

Penny deSaver says

Penny deSaver says

November 11, 2016 at 9:41 AMThis is a good idea. I usually sleep on things and if I still feel strongly about them (a mere 24 hours later) I figure me and the item in question must be meant to be together. But making a 30 day list seems like a much better plan to give your rationale a chance to overcome emotions.

Fulltimefinance says

Fulltimefinance says

February 17, 2017 at 9:06 AMI like the idea. Communication is the key to less fights. The longer you both have to think about it the more likely someone will change their mind. Thankfully my wife and I are on the same financial page. Usually when she has something to spend on it’s important like redoing our wills.

Hero says

Hero says

February 21, 2017 at 2:21 PMIf you’re fighting about big time items like wills, that’s a great sign that you’re on the right path financially, FTF. And yes, I agree – time has a way of providing clarity that we can rarely hope to attain in the heat of the moment.