This post may contain affiliate links. FinanceSuperhero only recommends products we know and trust ourselves.

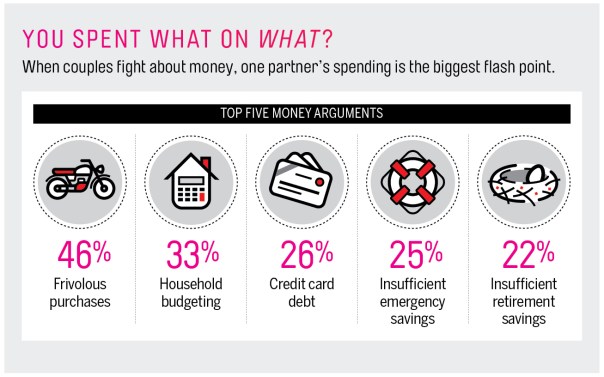

According to a Huffington Post article from 2014, a survey showed “that 70 percent of couples argued about money more than household chores, togetherness, sex, snoring and what’s for dinner.” Furthermore, survey records that the focus of 46% of all money fights was “frivolous purchases.” In my opinion, 54% of surveyed couples were not being entirely honest. And I bet 100% of couples would love to stop fighting over money with each other!

Even my wife and I find ourselves fighting over money more than anything else. Of the top five money arguments listed in the graphic below, we tend to argue most about our monthly budget allocations. In the grand scheme of things, we’re fortunate to be arguing about spending on things like dining out, clothing, and gifts to others. Though we mostly have our act together in this area, I’ll be honest – it still bugs me that these money fights pop up from time to time.

Mission: Stop Fighting Over Money With Your Spouse

I recently wrapped up another session of Financial Peace University at my church. I enjoyed engaging in financial discussions with others, despite the general unwillingness to do so in most people, and serving as a group leader satisfied my urge to help others while also helping me sharpen my own knowledge.

I recently wrapped up another session of Financial Peace University at my church. I enjoyed engaging in financial discussions with others, despite the general unwillingness to do so in most people, and serving as a group leader satisfied my urge to help others while also helping me sharpen my own knowledge.

During our session on purchasing with last year’s group, a student in my group shared that she and her husband had previously been fighting over money repeatedly over the years. I braced myself for a plea for advice, but what she said next surprised me.

“We found a solution that has stopped most of our money fights.”

Chatter among the group instantly ceased. Each group member, including me, was eager to learn this couple’s secret.

Solution: The Thirty Day List

In the moments which followed, we learned a lot about this couple’s experiences. Throughout their marriage and subsequent ushering of two children into the world, this couple had fought about many purchases: vehicles, clothing, electronics, and even groceries. Matters were not made any easier when the couple encountered financial hardships. In order to stop fighting over money, purchases, this couple implemented a procedure that they called “The Thirty Day List.”

They outlined the rules as follows:

When considering a purchase over $50, write the item and cost down on the list and date the entry.

Provide a brief rationale regarding the item’s utility and importance.

Revisit the rationale in 30 days. If it still sounds like a good idea at that time, purchase the item.

Naturally, many students (budget nerds) were in favor of this approach, while other students (free spirit spenders) were against the restriction associated with this process. However, as the couple explained how it worked for them, the tone of the room shifted toward acceptance of this uncommon procedure. Some people even expressed hope that use of The List could help them to stop fighting over money.

Why The List Works

Among the benefits of the list which were described that day include the following:

- The List often prevents unnecessary purchases. Sometimes you don’t buy the item because you realize don’t really need it.

- The List eliminates susceptibility to high-pressure sales techniques. When a smooth talking salesman is rolling out every tactic in his arsenal to get you to purchase that new refrigerator with built-in social media access, you don’t even have to feel bad saying “no” because you are acting on a matter of principle.

- The List causes you to wait, and sometimes this nets you a better deal. Patience puts you in a position to negotiate a great price. This extra time also allows you to thoroughly research a product, weigh the pros and cons of the purchase, and make a careful evaluation.

- Similarly, after waiting 30 days, you retain the willpower to reject a bad deal. What is a few more days? You are in control and have the power to walk away.

Why The List Works

The Thirty Day List works in many situations because it leads to communication. When a couple collaborates to generate a unified position, a meeting of the minds and melding of ideas is often the result. However, this does not always happen quickly. Simply starting the conversation can often be the hardest part!

The Thirty Day List works in many situations because it leads to communication. When a couple collaborates to generate a unified position, a meeting of the minds and melding of ideas is often the result. However, this does not always happen quickly. Simply starting the conversation can often be the hardest part!

In such cases, a couple must take a step back and view the possible purchase from a wider perspective. By considering the purpose of the purchase from a variety of perspectives, the tone of communication shifts from one which is adversarial to one which is inclusive of both partners’ values.

Related Posts: See Values and Budgeting Part One and Values and Budgeting Part Two

Finally, the List provides accountability for larger purchases. It provides a framework and protocol which eliminates one partner from “going rogue.”

Downsides to The List

While the Thirty Day List may seem fail-proof in theory, it can be more difficult to implement in actual practice. After all, we live in a society in which it is easier and (often preferred) to ask for forgiveness after the fact rather than seek permission in advance. Many people would agree that this is a terrible way to act within your marriage or other committed relationship, yet that doesn’t stop some people. If this is your preferred practice, the List won’t work well for you.

The List is also not a good idea when you find yourself in a housing search, especially in a seller’s market. Often times, you will need to be poised to make quick decisions. This shouldn’t be a surprise, however, as when you are in the midst of such a search, you know the rationale and utility for the purchase.

Make the List Work For You

Perhaps the best feature of the List is that it can be modified to fit your circumstances. A high school student with a part-time job and an annual income of $1,200 and a married couple with a combined annual income of $500,000 can successfully use the List to their respective advantages. The figures may need to be modified, but at the end of the day, the ideas remain the same whether zeros are added or removed.

If thirty days is too long for you, modify the procedure to fit your needs. You know yourself better than anyone, and using this knowledge is the best course of action when designing a List which will work for you to stop fighting over money and support wise purchases.

Further Recommended Reading:

Money and Marriage: How to Talk About Money With Your Spouse

Want To Be Rich? Maintain Great Relationships

Readers, do you have a procedure similar to The List in place to assist when making significant purchases? Do you and your spouse or partner routinely fight about purchases? How have you been able to stop fighting over money?

Mrs. Picky Pincher says

Mrs. Picky Pincher says

February 16, 2017 at 8:23 AMAyuuuup. Thankfully Mr. Picky Pincher and I only fight over absurd or stupid things like how to fold towels or loading the dishwasher.

There are civil ways to discuss money with your partner. Both Mr. Picky Pincher and I are guilty of making dumb purchases that didn’t make sense to the other. What’s important is to be transparent about it and assess how you can improve moving forward.

My father-in-law also suggested having “Bitch-Free” money for each person. It’s a small amount, about $50 a month, that you can spend however you please with zero input from your spouse. We don’t do it, but I do know it works for many couples.

Hero says

Hero says

February 21, 2017 at 2:24 PMI’ve always loved the concept of “Bitch-Free” money; I’ve heard others refer to it as “free money,” “play money,” or my favorite: “blow money.” For a long time in our marriage, my wife and I felt a strong need to have an allowance to blow each month with no questions asked. Today, we usually just discuss things as they come up, assuming they are sizable purchases, and we don’t sweat the small things unless they get out of hand over time.